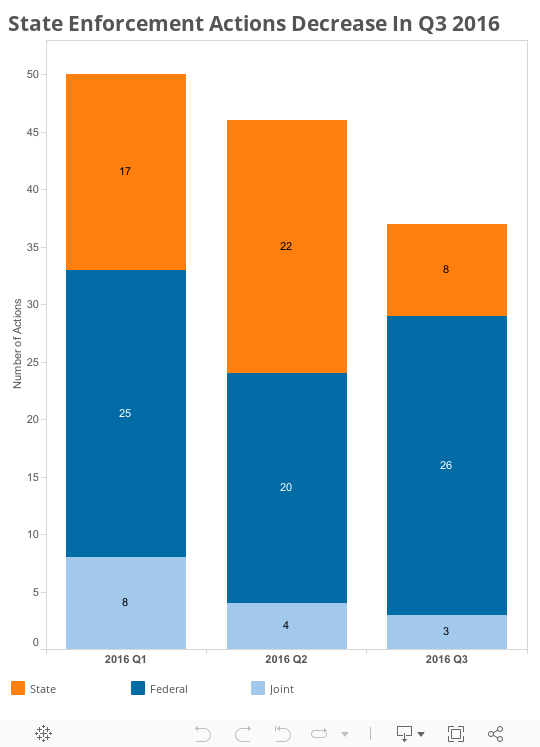

In the third quarter of 2016, Consumer Enforcement Watch tracked 37 enforcement actions taken against consumer financial service providers. This represents a decrease from the 46 enforcement actions that were tracked last quarter and the 50 actions that we tracked in Q1. 25 of the Q3 enforcement actions were settlements (with or without consent orders), while the remaining actions were court judgments, new actions, and new activity in ongoing enforcement actions.

State attorneys general and state regulatory agencies were significantly less active this quarter, bringing only 8 of the 36 new enforcement actions. In the prior quarter, state agencies accounted for over half of the tracked enforcement actions (26 of 46 total actions). This quarter, the Commonwealth of Massachusetts remained particularly active, resolving 4 separate actions. The State of Minnesota and the State of Colorado were the only other states to bring multiple actions (two) this quarter.

var divElement = document.getElementById(‘viz1479762651886’); var vizElement = divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’544px’;vizElement.style.height=’789px’; var scriptElement = document.createElement(‘script’); scriptElement.src = ‘https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);

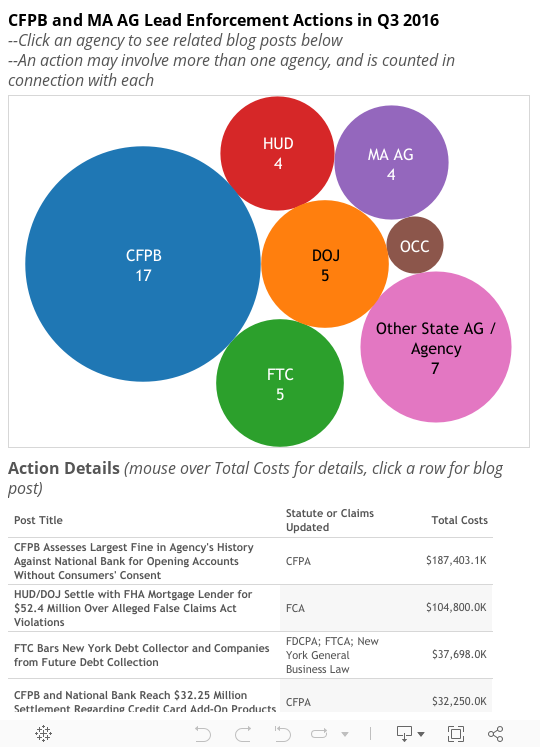

Federal enforcement activity mirrored that of past quarters. Once again, and consistent with 2015 and 2016 trends, the CFPB was the most active federal agency, initiating 15 enforcement actions on its own and another 2 actions jointly with the California Department of Business Oversight (DBO). And yet again, the Consumer Financial Protection Act (CFPA) was the statute most frequently at issue in Q3 actions. The Federal Trade Commission Act (6 times) and the Truth in Lending Act (7 times) were also invoked rather frequently this quarter.

var divElement = document.getElementById(‘viz1479758169991’); var vizElement = divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’544px’;vizElement.style.height=’789px’; var scriptElement = document.createElement(‘script’); scriptElement.src = ‘https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);

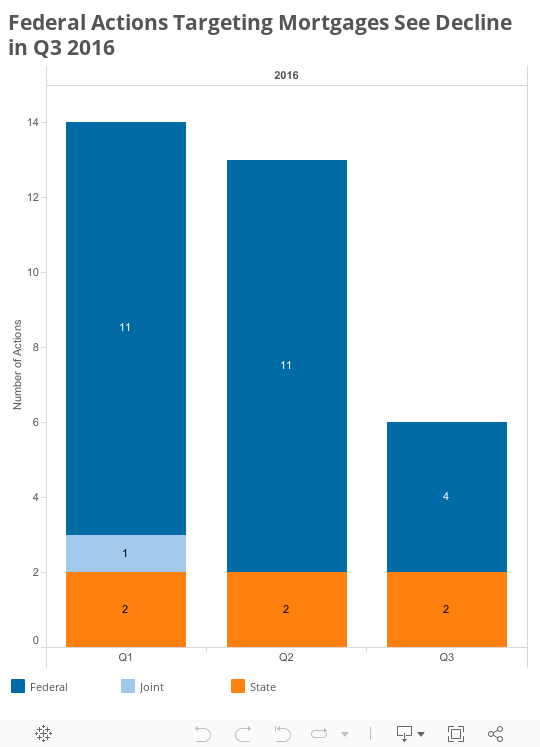

Mortgages remained a primary enforcement target, with 6 mortgage-related enforcement actions in Q3. This number is only about half the number of mortgage-related actions taken during the previous quarter (13). Although mortgages remain the most common enforcement target, we are now on pace for just 45 mortgage-related enforcement actions in 2016, down approximately 33% from the 68 mortgage-related actions we tracked in 2015.

var divElement = document.getElementById(‘viz1479762713133’); var vizElement = divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’544px’;vizElement.style.height=’789px’; var scriptElement = document.createElement(‘script’); scriptElement.src = ‘https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);

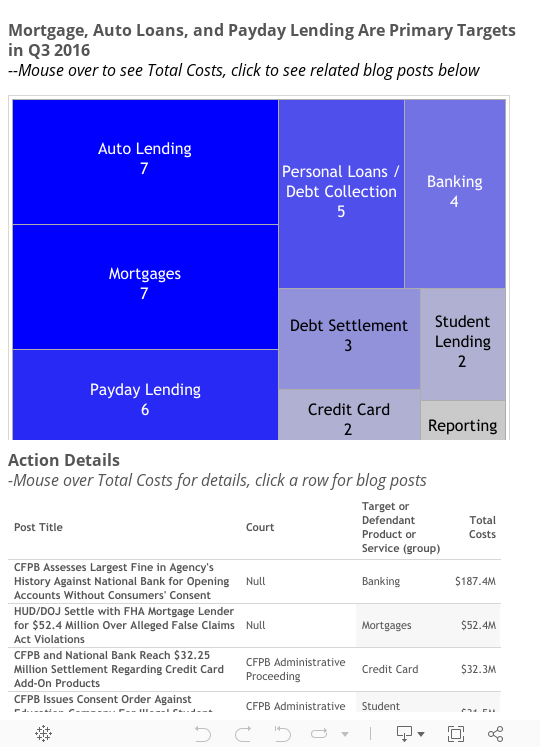

The third quarter also saw substantial enforcement activity in auto lending (7 actions) and payday lending (6 actions). While enforcement related to debt collection (5) and debt settlement (3) was similar to last quarter, the number of student lending actions decreased significantly, from 9 actions in Q2 to 2 actions in Q3. This quarter also saw the second and third credit card-related actions of the year.

var divElement = document.getElementById(‘viz1479762595236’); var vizElement = divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’544px’;vizElement.style.height=’789px’; var scriptElement = document.createElement(‘script’); scriptElement.src = ‘https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);

Federal and state actions resulted in just over $300 million in civil penalties and settlement payments to the government this quarter—again, down significantly from the approximately $1.5 billion in penalties and settlements from last quarter. Over half of this amount came as a result of the CFPB’s record $185 million fine assessed against a national bank in relation to its deposit account and credit card practices. An additional $52.4 million was obtained in yet another Federal Housing Administration (FHA) settlement relating to a mortgage lender’s participation in HUD’s FHA insurance program.

Enforcement agencies also collected approximately $100 million in consumer relief or restitution, which is significantly higher than the $31 million that Enforcement Watch tracked in Q2, but still far lower than the $750 million of consumer relief tracked in Q1. Notably, that relief includes a $32.25 million consent order reached between the CFPB and a national bank relating to its credit card add-on products, as well as a $31.5 million consent order between the CFPB and a for-profit college relating to its student lending practices. The remainder is largely attributable to the FTC, which obtained over $18 million in restitution from a New York debt collector for its debt collection practices.

Consumer Finance Enforcement Watch will continue to post quarterly and annually on trends in consumer finance enforcement activity. For specific questions regarding trends by enforcers, industry, or other data, please feel free to contact Kyle Tayman, Joseph Robbins, or Levi Swank.