*Editor’s Note: This post originally appeared on our sister blog, Consumer Finance Enforcement Watch. Visit CFEW for more real-time reporting and data analytics on the full range of public federal and state consumer finance enforcement activity and the latest updates to our interactive charts.*

For the first quarter of 2016, Consumer Finance Enforcement Watch tracked 50 enforcement actions taken against consumer finance providers, marking a slight increase from the 46 actions we had tracked a year ago in Q1 2015. Of the Q1 2016 enforcement actions, the majority were settlement agreements.

For the first quarter of 2016, Consumer Finance Enforcement Watch tracked 50 enforcement actions taken against consumer finance providers, marking a slight increase from the 46 actions we had tracked a year ago in Q1 2015. Of the Q1 2016 enforcement actions, the majority were settlement agreements.

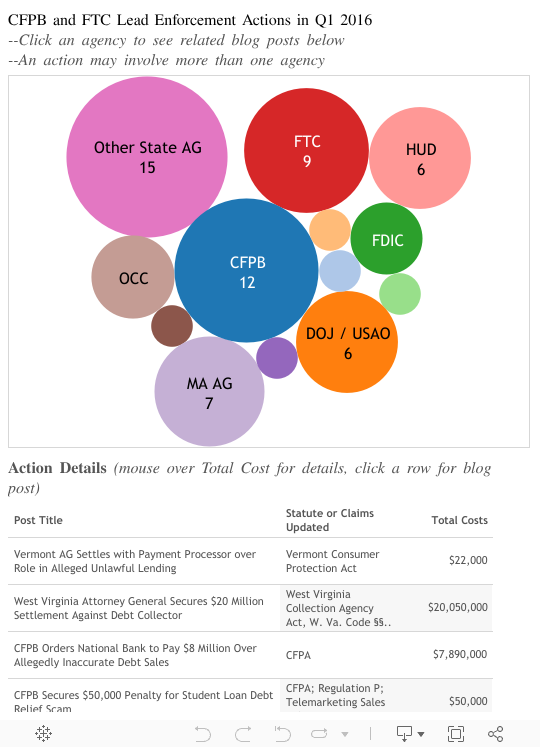

Consistent with the trend observed in 2015, federal agencies continue to bring the majority of actions, compared to actions by state attorneys general and state regulatory agencies. Three actions were brought jointly by state attorneys general and federal agencies. The CFPB remains the most active federal agency, having initiated twelve enforcement actions. The Massachusetts Attorney General’s Office was notably involved in 7 enforcement actions, which exceeded the number of enforcement actions brought by the attorneys general of more populous states such as Florida (2) and New York (2).

The Federal Trade Commission Act (10), the Consumer Financial Protection Act (6), and the Fair Housing Act (4) were the most frequently cited statutes in the actions Enforcement Watch tracked. Enforcement agencies also brought (3) actions under the Equal Credit Opportunity Act, demonstrating a continued focus on fair lending.

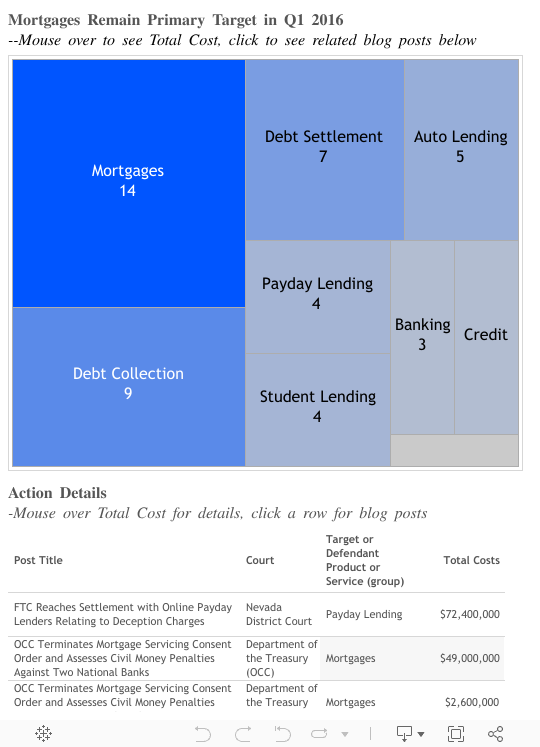

Enforcement activity was fairly dispersed across the various consumer financial products and services. Mortgages remain a primary target of enforcement actions, with 14 brought in the first quarter of 2016, though this is down 33% from the 21 actions we tracked in the first quarter of 2015. Further, mortgages are on pace for only 56 enforcement actions in 2016, compared to the 68 mortgage-related actions we tracked in 2015. Another notable downward trend in Q1 is the lack of any enforcement actions concerning credit cards, when over a dozen such actions were tracked in 2015. Federal and state agencies continue to bring enforcement actions against debt collectors (9), debt settlement companies (7), auto lenders (5), student lenders (4), and payday lenders (4). Unlike credit card-related actions, the number of actions brought against debt collectors and debt settlement companies is trending up slightly.

Federal and state actions resulted in over $300 million worth of civil penalties and settlement payments to state and federal governments in the first quarter of 2016. More than half of this amount ($171,500,000) came from a joint enforcement action brought by the U.S. Department of Justice, U.S. Department of Housing and Urban Development, CFPB and 50 state attorneys general against a national bank for alleged mortgage origination, servicing, and foreclosure abuses. The amount of the penalty also includes a consent order entered into with the Federal Reserve Board concerning similar allegations. Another major civil penalty ($48,000,000) against a national bank also came as a result of allegations concerning its mortgage servicing practices. In that case, the Office of the Comptroller of Currency claimed that the bank violated an existing consent order it had entered into in April 2011.

Enforcement activity also resulted in almost $750 million in direct consumer relief or restitution to consumers, more than half ($410,500,000) of which was obtained through the joint enforcement action noted above. Other notable consumer relief awards came from a $132,882,488 judgment the CFPB obtained against a debt relief company that was alleged to have charged upfront fees in violation of the Consumer Financial Protection Act. Additionally, the Federal Trade Commission (FTC) reached a large settlement with two online payday lenders resulting in the waiver of $68,000,000 in uncollected consumer fees. The remedies obtained in the first quarter of 2016 seem to continue a trend of enforcement agencies preferring direct consumer relief where possible.

Consumer Finance Enforcement Watch will continue to post quarterly and annually on trends in consumer finance enforcement activity. For specific questions regarding trends by enforcers, industry, or other data, please feel free to contact Sabrina Rose-Smith, Kyle Tayman, or Joseph Robbins.